If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

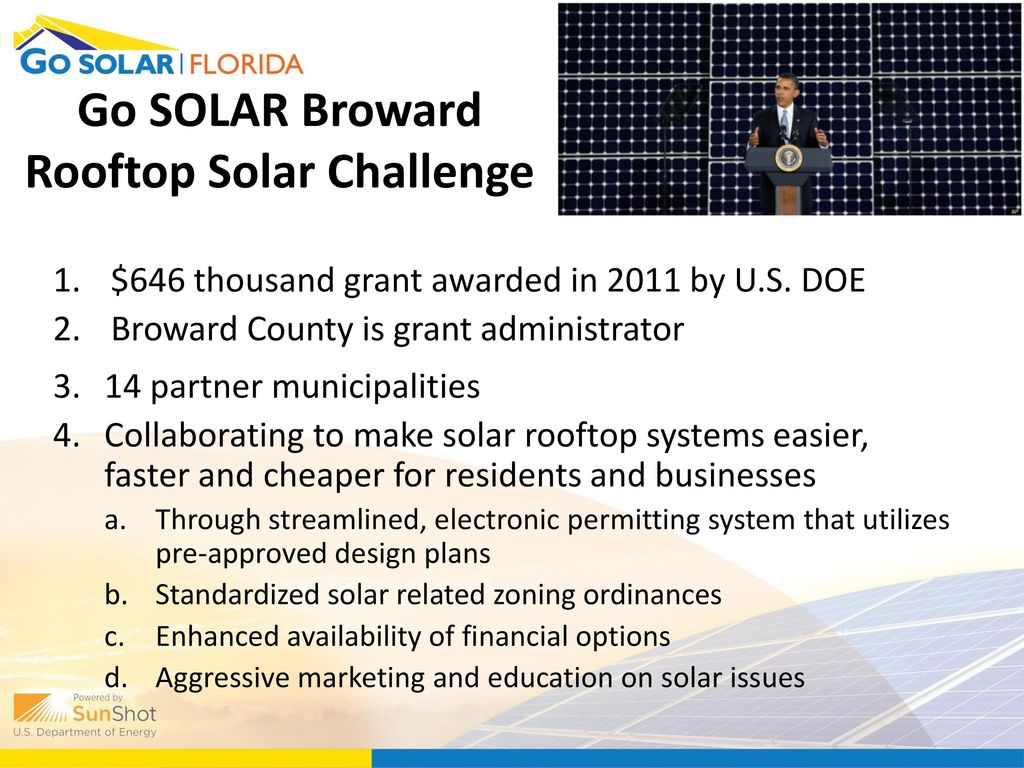

Solar panel credit broward county credit.

25d d 1 and 2 solar water heating panels and solar electric photovoltaic panels must be installed for use in a dwelling located in the united states and used as a.

Filing requirements for solar credits.

Homeowners solar companies and industry advocates alike were given a big christmas gift in 2015 when congress approved the 2016 federal spending bill and extended the solar panel tax credit.

The combination of excellent sun exposure the solar tax credit a great net metering policy and some of the strongest financing options in the u s.

When you install a solar power system the federal government rewards you with a tax credit for investing in solar energy.

To claim the credit you must file irs form 5695 as part of your tax return.

This generous rebate effectively knocks off 26 percent of the cost of your new solar energy system right off the bat as a credit on your income tax.

You calculate the credit on the form and then enter the result on your 1040.

8 that means if you purchase a 6 kilowatt system for 18 300 you ll pay.

When you buy solar panels for your home you receive a 26 federal tax credit plus an additional 5 in savings on us.

The bottom line is this.

Florida solar air designs solar panels systems that are in compliance with all federal reporting regulations in order to take complete advantage of this tax program.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans.

In new york city s solar tax abatement program you can currently take 5 of your solar panel system installation expenses and deduct that amount of money from your property taxes for 4 years.

Florida solar power overview.

Florida is one of the best places in the nation for installing solar panels.

Importantly abatements are calculated before other tax exemptions like the federal tax credit for solar meaning you can claim an abatement based on.

In fact 26 of your total project costs including equipment permitting and installation can be claimed as a credit on your federal tax return.

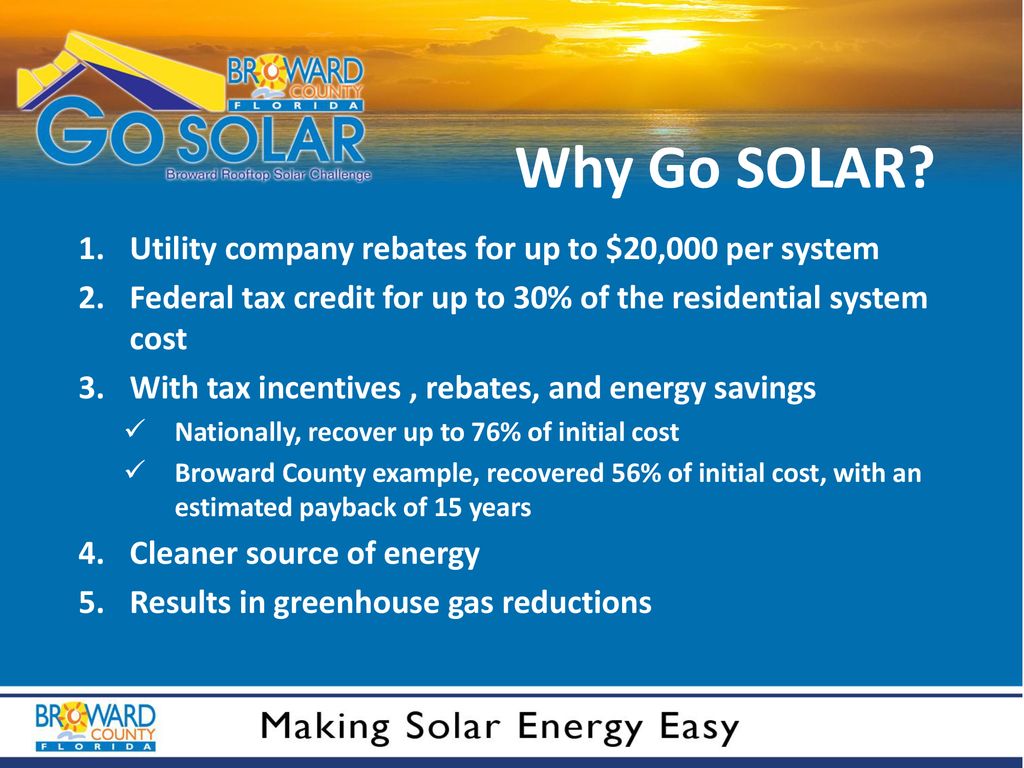

In addition to florida s net metering policy and tax exemptions to encourage solar energy the federal government gives you another huge incentive known as the investment tax credit itc.

In addition to florida s state solar programs you ll be eligible for the federal solar tax credit if you buy your own home solar system outright.

In 2019 the tax credit can reduce the cost of a solar installation by 30 7 including a solar battery purchase.